Written by:

Matas Kibildis

Head of Growth @ AIclicks

Reviewed by:

Rokas Stankevicius

Founder @ AIclicks

Competitive intelligence in 2026 isn’t just “track competitors and call it a day.” Your competitive landscape now changes across search engines, AI answers (ChatGPT, Gemini, Perplexity, and so on), social, review sites, pricing pages, job posts, and market signals. The right competitive intelligence tools turn that noise into actionable insights. So marketing teams, product leaders, and sales teams can make faster, better-informed decisions.

Below is a no-fluff shortlist of the top competitive intelligence tools for 2026, combining classic CI platforms with newer AI-powered tools that track how buyers actually discover brands today.

Quick comparison table

Tool | Best For | Coverage | Key Features | Strengths | Limitations | Pricing |

|---|---|---|---|---|---|---|

AIclicks | AI search competitive intelligence + brand visibility | Major LLMs + AI search surfaces | Prompt tracking, competitor benchmarking, citations + sentiment, recommendations | Best for “how AI describes you vs competitors” and AEO/GEO workflows | Not a full traditional CI suite (e.g., win/loss interviews) | From $79/mo (Starter promo listed), scales up |

Crayon | Enterprise CI + sales enablement | Competitor sites + updates + internal enablement | Battlecards, newsletters, win/loss + adoption metrics, Salesforce/Slack integrations | Built for CI programs that need distribution + governance | Can feel heavy if you only need lightweight competitor monitoring | Quote-based (typical enterprise) |

Klue | CI + win/loss in one system | CI + buyer interviews + enablement | Deal-based insights, win/loss research, distribution into workflows | Strong for strategic analysis + sales coaching loops | More process-driven; setup requires buy-in | Quote-based (demo-led) |

Kompyte | Automated competitor monitoring + battlecards | Websites, product pages, reviews, PR, jobs, etc. | Automated tracking, alerting, “millions of data points,” prioritization | Great “set-and-forget” competitor data engine | UI/process can be a learning curve for some teams | Pricing often demo/quote-led |

Similarweb | Market intelligence + digital benchmarking | Traffic, audiences, keywords, market segments | Market trends, competitor traffic estimates, segment benchmarking | Strong market dynamics + market positioning signals | Pricing and depth scale quickly for teams | From $199/mo starter |

Semrush | Competitive analysis (SEO + PPC + content) | Keywords, SERPs, backlinks, ads (toolkit-based) | Keyword research, gap analysis, competitive research toolkit | One of the best competitive analysis tools for SEO-led teams | AI/advanced modules may be add-ons; can get complex | From $139.95/mo |

Ahrefs | Backlinks + SEO competitor research | Crawled web + SERP history | Competitor research, content gap, Site Explorer, rank tracking | Elite link + content intelligence | Less “sales enablement” out of the box | From $129/mo |

Crunchbase | Company + funding + firmographic competitor intel | Private market + company records | Company tracking, lists, alerts, prospecting | Solid competitor data for markets + partnerships | Not a website-change tracker; depth varies by region | From $99/mo |

Brand24 | Social listening + competitor insights for SMB/mid-market | Social, news, blogs, forums, etc. | Monitoring, alerts, analysis, AI features | Quick insights into sentiment + share-of-voice shifts | Not a full CI platform; noise filtering takes tuning | From $199/mo |

AlphaSense | Enterprise intelligence + market research | Filings, transcripts, research (enterprise-grade) | Advanced search capabilities, GenAI summaries, monitoring | Great for strategic intelligence + risk management workflows | Typically expensive; overkill for small teams | Annual subscriptions; contact sales |

TL;DR (what to pick)

If you care about AI answers (ChatGPT/Gemini/Perplexity) and want competitive insights you can act on: AIclicks.

If your CI program supports sales enablement with battlecards and governance: Crayon (or Kompyte for automation-first).

If you need CI tied to win/loss and buyer feedback loops: Klue.

If you want market intelligence platforms' signals (traffic, audiences, market trends): Similarweb.

If your “CI” is mostly competitive analysis for SEO/PPC: Semrush or Ahrefs.

If you need competitor data on companies, funding, and market maps: Crunchbase.

If you need fast social and PR monitoring, Brand24 (and graduate to heavier enterprise suites later).

If you’re doing serious market research and diligence: AlphaSense.

The best competitive intelligence tools for 2026 (full reviews)

1) AIclicks: Best for AI search competitive intelligence (AEO/GEO)

If your buyers are using AI to shortlist vendors, you need CI that shows how AI models describe you vs. competitors, not just who ranks #1 in Google. AIclicks is built for this newer layer of competitive and market intelligence: it runs prompt-based tracking across major AI surfaces and shows where you appear, how often you’re cited, and what sources influence those answers.

Strengths

Designed for AI-powered competitive intelligence: prompts → visibility rate → citations → sentiment → “what to do next.”

Competitive benchmarking that’s actually usable for marketing strategies (where you win/lose, which web pages get cited, and what content gaps matter).

Great for teams that treat AI visibility like a new channel (similar to SEO), with clearer data visualization and reporting than stitching together spreadsheets.

Weaknesses

Not a replacement for classic CI workflows like formal win/loss programs, long-form battlecards, or enterprise intelligence governance.

You’ll still want other analytics tools for deep ad intel, CRM enrichment, or broader market data.

Pricing

From $79/mo with a Starter promo, scaling upward for larger teams/usage.

Check out this video where we share the exact strategy that took AIclicks from zero to #5 in AI visibility rankings in just 90 days:

2) Crayon: Best for sales enablement CI at enterprise scale

Crayon is the archetype of a modern competitive intelligence platform built for enablement: gather competitor updates, turn them into battlecards, and deliver them where sales teams actually work (think Salesforce and Slack). It shines when your goal isn’t just “collect competitor website changes,” but operationalize intel across GTM.

Strengths

Battlecards and distribution workflows are first-class (CI that actually gets used).

Strong for building a centralized platform where product marketing can ship consistent positioning, proof points, and competitive insights.

Great fit for orgs that care about adoption, enablement metrics, and repeatable CI processes.

Weaknesses

If you only need lightweight monitoring of competitor websites and a few alerts, it can feel like more than you need.

Expect a real implementation cycle (permissions, workflows, training).

Pricing

Generally sold via demo/quote (typical for competitive intelligence companies in the enterprise category).

3) Klue: Best for competitive insights and win/loss in one place

Klue positions itself as “one platform” for competitive intelligence and win/loss, useful if you want to combine competitor research with direct buyer feedback and remove bias from your competitive strategy. In practice, it’s strongest when CI is a cross-functional program, not a side project.

Strengths

Win/loss depth and deal-based insights help turn messy feedback into detailed insights you can ship back into positioning, product, and sales plays.

Strong collaboration tools for distributing intel in the systems teams already use.

Good fit for strategic analysis: not just “what changed,” but “why we lost and what to fix.”

Weaknesses

More process-heavy than point solutions; adoption requires internal champions.

If your needs are mostly SEO/keyword research CI, it’s not the fastest route.

Pricing

Quote-based (demo-led).

4) Kompyte: Best for automated competitor monitoring and fast battlecards

Kompyte focuses on automating the messy part: collecting competitor data from a wide range of data sources (websites, product pages, review sites, PR/blogs, app stores, job postings, and more). The pitch is simple: spend less time collecting data points, more time acting on competitor insights.

Strengths

Broad coverage across “competitor digital footprint” sources, great for always-on monitoring.

Good for marketing teams that want to track competitors' strategies like messaging shifts, pricing pages, and launch patterns.

Useful for sales enablement when you need fresh battlecards and alerts.

Weaknesses

You’ll need tuning to avoid alert fatigue (common to automated CI).

Some teams report a steep learning curve when trying to structure outputs for multiple stakeholders.

Pricing

Pricing is often handled via demo/quote, depending on scale.

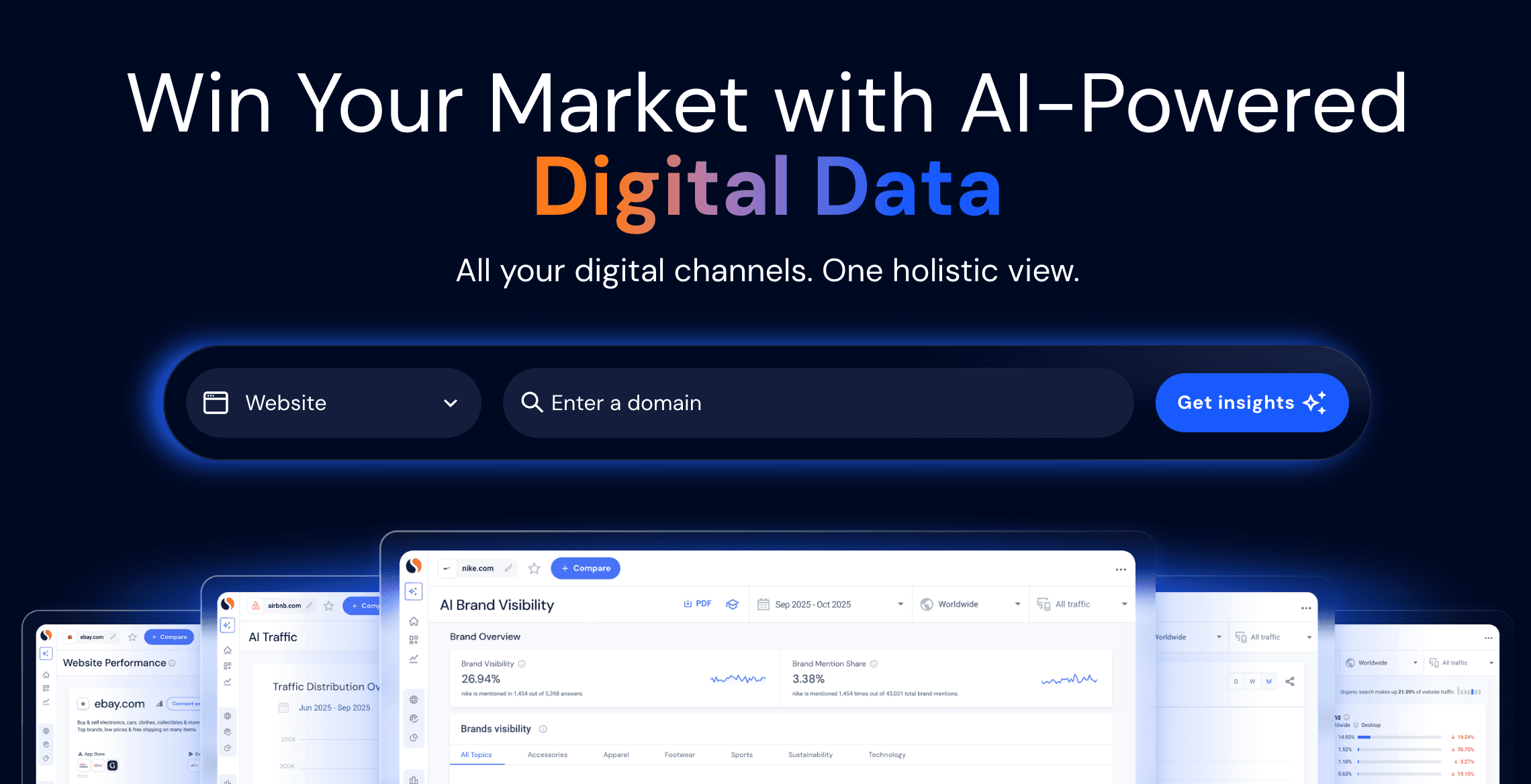

5) Similarweb: Best for market intelligence and competitor traffic benchmarking

Similarweb is a go-to for competitive and market intelligence based on digital behavior: estimated traffic, channel mix, audience interests, and macro market trends. It’s less about “battlecards” and more about market dynamics and market positioning, especially when you’re sizing segments or validating competitive analysis beyond your own analytics.

Strengths

Great for market research questions like “who’s growing,” “where their traffic comes from,” and “what emerging trends show up in demand.”

Useful data visualization for exec-friendly storytelling (share-of-traffic, segment shifts, etc.).

Weaknesses

It’s not a specialized CI workflow tool (no classic battlecard lifecycle).

Costs can ramp quickly as you unlock deeper history, more geos, and exports.

Pricing

$199/month starter tiers, with larger plans billed annually and scaling into five figures.

6) Semrush: Best for competitive analysis across SEO and PPC

If your competitive environment is largely “who wins search,” Semrush is still one of the most practical competitive analysis tools. It’s strong for keyword research, content gaps, competitor SEO tracking, and paid search recon, helping you tie competitor moves to search engine rankings and demand capture.

Strengths

Excellent for competitor data around keywords, content strategy, and PPC.

Helpful for marketing teams that need repeatable reporting and quick wins.

Weaknesses

It can become a toolkit sprawl (lots of modules; not all teams use them well).

Advanced capabilities sometimes live behind add-ons; you’ll want to map your use cases first.

Pricing

Commonly reported pricing: $139.95/mo (Pro) and $249.95/mo (Guru), with larger tiers above that.

7) Ahrefs: Best for backlink intelligence and content gap research

Ahrefs is the “I need to understand why they outrank us” tool. It’s built around web-scale crawling, backlink analysis, and competitor content research. If your CI is anchored in SEO, it’s one of the best sources of competitor data you can get, especially for link profiles and content that earns citations.

Strengths

Good backlink and content research for competitive research and SEO-driven market analysis.

Great for identifying which competitor web pages attract links and visibility, and where you can realistically compete.

Weaknesses

Not designed as a full competitive intelligence platform (no enablement workflows).

Can be complex for teams that only need lightweight insights.

Pricing

Plans include $129/mo (Lite), $249/mo (Standard), and $449/mo (Advanced).

8) Crunchbase: Best for company, funding, market maps (competitor intel)

Crunchbase is a classic for competitor analysis when you need structured company data: funding, investors, acquisitions, leadership signals, and lists you can monitor over time. It’s not a “competitor websites change tracker,” but it’s strong for building a competitive landscape map and keeping tabs on competitive intelligence information that matters to strategy teams.

Strengths

Useful for identifying competitors, adjacent players, and fast movers (especially in tech).

Great for tracking company changes that impact market positioning (funding, hires, expansion).

Weaknesses

Doesn’t replace web monitoring tools; it’s better for firmographics than real-time messaging shifts.

Coverage quality varies by region/industry.

Pricing

Pro monthly is $99/month (pay-as-you-go).

9) Brand24: Best for affordable social listening CI

Brand24 is a practical pick when you want social and web monitoring to understand competitor moves, PR spikes, and customer behavior signals in the wild. It’s not “enterprise intelligence,” but it’s a strong, approachable way to capture competitor insights from social, news, blogs, and forums, then filter down to valuable insights.

Strengths

Strong for monitoring brand/competitor mentions, sentiment shifts, and campaign impact.

Useful for spotting emerging trends early (spikes, stories, and communities talking).

Weaknesses

Like any listening tool, you need strong queries and ongoing tuning to reduce noise.

Doesn’t provide full CI workflows, such as battlecard governance or advanced user permission management at the enterprise suite level.

Pricing

$199/mo Individual (or $149/mo billed annually), scaling through Team/Pro/Business and Enterprise.

10) AlphaSense: Best for high-end market research + strategic intelligence

AlphaSense is built for deep research: market intelligence across filings, transcripts, analyst research, and enterprise sources, then faster discovery through advanced search and AI-driven summaries. It’s the kind of platform you buy when competitive intelligence is critical to investment decisions, corporate strategy, or serious risk management, not just weekly competitor updates.

Strengths

Excellent for strategic analysis and diligence workflows where sources and accuracy matter.

Strong for surfacing critical insights fast across massive corp/market datasets.

Weaknesses

Often overkill for SMBs or teams mainly doing marketing CI.

Budget and procurement can be a barrier (typical enterprise pricing motion).

Pricing

AlphaSense sells annual subscriptions (enterprise to per-seat), via sales.

How to pick the best competitive intelligence tool

Picking from the most recommended competitive intelligence tools is easier when you start with your decision-making rhythm.

The best tool is the one whose competitive intelligence capabilities match the questions your team needs answered every week, then makes those answers easy to share and act on.

1) Define your main job to be done

Different teams mean different “best” tools.

If you need market and competitive intelligence at a category level, look for strong market data, benchmarking, and trend views.

If your priority is monitoring company websites, pricing pages, landing pages, and product updates, choose a platform built for reliable tracking and alerts.

If sales enablement is the goal, you need battlecards, notifications, and permission controls that help teams actually use the intel.

2) Map data sources to how your buyers decide

Your tool should reflect where prospects form opinions.

For search-led acquisition, you need search engine optimization signals such as keyword gaps, search engine rankings, and content momentum.

For brand perception and narrative shifts, you need coverage that supports social media management and captures mentions, sentiment, and share of voice.

For AI-driven discovery, look for advanced AI search features that measure how artificial intelligence systems present your brand and competitors. This includes prompt-level tracking, citation sources, and changes over time.

3) Prioritize speed from insight to action

It is not enough to collect competitor data. The platform enables action when it helps you gain valuable insights quickly and consistently.

Look for automation and machine learning features that help prioritize what matters and reduce noise.

Make sure it supports collaboration, so updates turn into clear tasks for marketing, product, and sales.

4) Make sure reporting fits your stakeholders

A tool can be powerful and still fail if reporting does not match how your team works.

Executives usually need clean visualization tools and high-level summaries that show market shifts and competitive movement.

Operators need the ability to drill down into specific pages, claims, and changes, then export data for analysis.

Sales teams need simple, credible talking points they can use immediately.

5) Decide when you need dedicated tools versus a BI stack

Business intelligence and data analysis tools are great for internal performance data, but they often do not capture external changes reliably. Dedicated tools are usually better for monitoring competitors, tracking messaging changes, and turning external signals into usable outputs. If you already have BI in place, a CI tool should complement it by covering what BI typically misses.

Conclusion

Competitive intelligence in 2026 is a practical growth lever, not a nice-to-have research project. Industry trends shift faster than most planning cycles, buyers compare options across search, social, and AI tools, and competitor narratives can change before you notice in the pipeline. The right stack helps you gain valuable insights from the outside world, then translate them into decisions your team can act on.

That is why AIclicks stands out as the best option for 2026. While many platforms do a strong job tracking company websites, monitoring social signals, or supporting sales enablement, AIclicks focuses on the channel that is rapidly becoming the first touchpoint for research: AI-driven discovery.

Used alongside SEO and business intelligence tools, AIclicks gives teams a clear, defensible competitive advantage by helping them understand and win in the environments where modern buyers now form opinions.

Our Content:

Guide

How to Use Perplexity AI (Like a Pro) in 2026

Feb 12, 2026

Guide

How to Get Backlinks to Your Site in 2026

Feb 12, 2026

Tools

8 Best AI Search Engines in 2026

Feb 12, 2026

Tools

9 Best LLM SEO Tools for 2026 (and how to pick the right one)

Feb 12, 2026

Tools

10 Best LLM Optimization Tools in 2026

Feb 12, 2026

Tools

9 Best tools for tracking LLM visibility in 2026

Feb 12, 2026

Any questions left?

Book a call here: